Short on cash?

We’re here to help.

Hutsy helps you improve your credit score, and matches you to pre-approved loans up to $15,000.

MoneyLion

A leading all-in-one financial platform helping users build credit, save, and invest smarter.

Avant

A trusted online lender offering personal loans and credit solutions with fast, transparent service.

Citibank

A global financial institution providing world-class banking, lending, and wealth management services.

Chime

A modern neobank delivering fee-free banking and innovative financial tools for everyday users.

SoFi

A digital finance leader empowering members with lending, investing, and banking solutions for every stage of life.

Brigit

Brigit is a financial app that provides cash advances and budgeting tools to help you avoid overdraft fees.

AIG

AIG is a global insurer offering a wide range of financial and insurance products, including life insurance, etc.

MoneyLion

A leading all-in-one financial platform helping users build credit, save, and invest smarter.

Avant

A trusted online lender offering personal loans and credit solutions with fast, transparent service.

Citibank

A global financial institution providing world-class banking, lending, and wealth management services.

Chime

A modern neobank delivering fee-free banking and innovative financial tools for everyday users.

SoFi

A digital finance leader empowering members with lending, investing, and banking solutions for every stage of life.

Brigit

Brigit is a financial app that provides cash advances and budgeting tools to help you avoid overdraft fees.

AIG

AIG is a global insurer offering a wide range of financial and insurance products, including life insurance, etc.

Get matched with lenders in seconds

Apply once — we instantly send your application to 20+ trusted lenders. Compare personalized offers side-by-side with no impact on your credit score.

Pick your offer and get funded

Review your pre-approved offers, choose the best rate and term, and accept directly through Hutsy. Fast, simple, and transparent — funds in your account in as little as 24 hours.

Coming Soon

Stay on top of your credit with Hutsy

Hutsy tracks your score, finds what’s holding it back, and guides you with simple steps to build stronger credit — with no impact or hidden fees.

Coming Soon

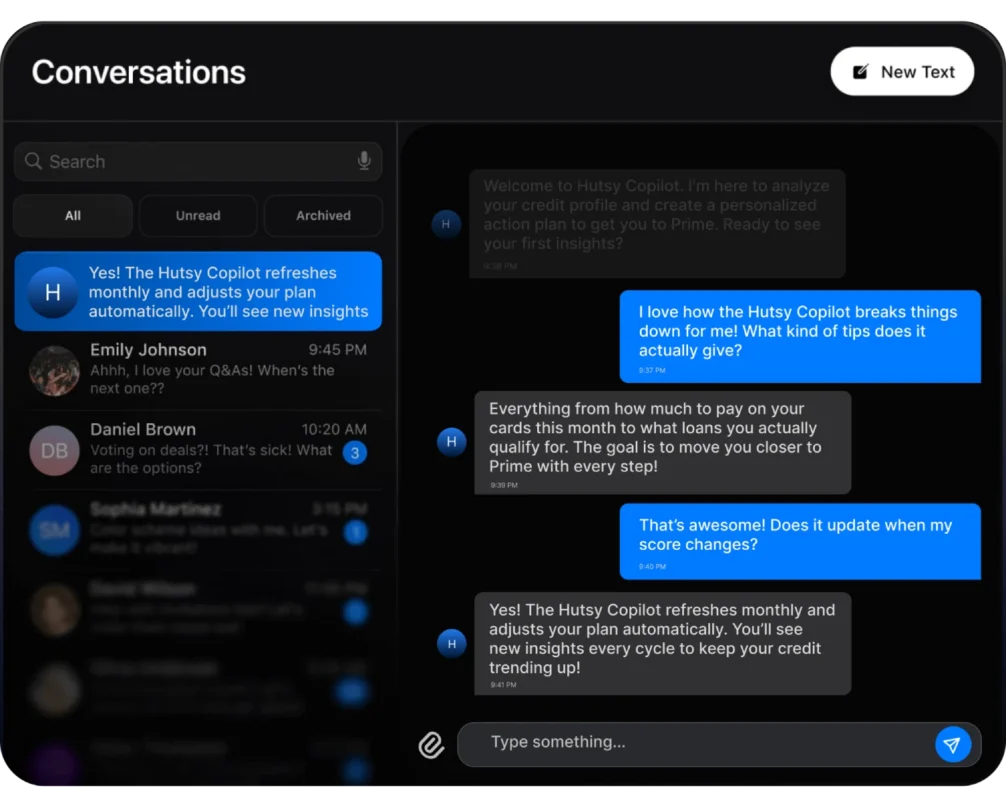

Money talks. Hutsy talks back

Text Hutsy like you would a friend — it tells you what to pay, when to save, and how to keep your credit moving in the right direction.

The reviews speak for themselves

I applied in minutes and was instantly matched with a $5,000 loan offer. The process was way easier than going bank to bank!

— JakeOnABudget 🇨🇦I didn’t think I’d qualify, but Hutsy connected me with multiple lenders. I picked the best rate and had funds in my account the next day.

— SarahLovesSavings 🇨🇦Super simple — I selected my loan amount, saw offers right away, and chose the one that fit my budget.

— JasonH22 🇨🇦I love that I could compare offers from different lenders all in one place. It saved me so much time.

— EmmaT 🇨🇦The approval came back in seconds. I didn’t have to fill out a dozen applications — just one.

— Nathan_D 🇨🇦Funds hit my account within hours after I accepted the offer. Exactly when I needed it most.

— BudgetQueen 🇨🇦I felt in control the whole way — I chose the lender, the terms, and where the money was sent.

— SamInNYC 🇨🇦The app is straightforward and transparent. No hidden fees, just clear loan offers.

— JakeSaves 🇨🇦I was able to go from application to approval in less than 10 minutes. Honestly the smoothest loan experience I’ve had.

— TVAddict92 🇨🇦I was stressed about covering bills, but Hutsy helped me secure a $2,500 loan in less than a day.

— FinanciallyFree22 🇨🇦"The process was fast and painless — just a few taps and I had multiple offers to choose from."

— DebtFreeSoon 🇨🇦I finally felt like I had options instead of getting declined everywhere else.

— TomTheSaver 🇨🇦Hutsy made borrowing simple. I picked the amount I needed and saw lenders willing to work with me.

— SavvySpender 🇨🇦The funds went straight into my bank account, and I could track everything in the app.

— ChloeOnABudget 🇨🇦I liked that Hutsy checked back each week until I was approved. It showed they were looking out for me.

— NoMoreWastedCash 🇨🇦Getting matched with lenders through Hutsy saved me from applying on a dozen different websites.

— JakeK 🇨🇦I used Hutsy when my car broke down, and the loan came through faster than I expected.

— AlexF 🇨🇦Seeing multiple offers side by side gave me confidence I was getting the best deal.

— BudgetBenny 🇨🇦

Built for privacy. Your finances, fully private and secure.

Hutsy is built with your privacy in mind. Your financial data stays protected with industry-standard encryption and is never sold, tracked, or shared without your consent. No ads, no gimmicks—just tools to help you save money and stay in control.

Hutsy is in the process of becoming a B Corporation meaning we’ll legally be committed to putting your privacy and well-being first.

Watch Lip explain how Hutsy spots you when needed to pay your bills below 👇

One Application 20+ Lenders

Apply once — we instantly send your application to 20+ trusted lenders. Compare personalized offers side-by-side with no impact on your credit score.

Have a question?

What is Hutsy?

Hutsy is your financial assistant built to help you move from subprime to prime credit. Hutsy analyzes your bank credit data, gives you clear steps to improve, and connects you to pre-approved offers from over 20 trusted lenders—all in one place.

Does Hutsy issue loans directly?

No—Hutsy is not a direct lender. Instead, we partner with a network of 20+ trusted lenders (including banks and fintechs) to match you with the best available loan offers based on your profile. You’ll see personalized options without impacting your credit score.

What happens if I’m denied for a loan?

What’s the main goal of Hutsy?

How often does my credit score update?

Your credit data updates once per month. Each refresh shows how your score has changed, what factors improved or declined, and what next steps Hutsy recommends to keep you moving toward Prime.

How does Hutsy protect my data?

How do I contact Hutsy?

© 2025 Hutsy. All Rights Reserved.

Terms & Privacy